Assortment optimization strategies for CPG brands

A step-by-step guide to find and rank store-item opportunities using POS, planograms, and category benchmarks.

Consumer packaged goods (CPG) suppliers and retailers both win when they nail the optimal assortment. That means the right mix of products on the right physical and digital shelves, always available, and aligned with consumer expectations for a seamless shopping experience.

The smartest category leaders are continuously optimizing their assortment strategies, recognizing that not all products warrant equal investment in the competitive retail environment. J.M. Smucker, for instance, developed a targeted cluster strategy for its pet dental products by leveraging detailed SKU and store-level sales data. The team identified high-demand store groups best suited for new dental innovations and adjusted shelf space in lower-performing clusters accordingly, seeing incremental sales growth as a result.

What is a retail assortment?

A retail assortment is the mix of products planned for shelves at stores and clusters. The aim of the assortment is to maximize profit margin and sales. Finding the right mix to provide options and drive profitable sales is the core goal. Category managers also aim to grow the category as a whole while minimizing overstock and markdowns.

The optimal retail assortment can be measured by:

- Shelf location

- Facings

- Units per facing

- Nearby items that influence purchase decisions

The nature of each category is also relevant, with some retailers breaking them down by those which are traffic drivers; categories with routine and stock-up products; High profit margin categories; and seasonal and experimental. This influences the SKUs which retailers will consider for expansion.

Optimizing assortments also takes omnichannel considerations into account, with important channels including:

- Online pick-up orders

- Local deliveries (via retailer app, Instacart, DoorDash)

- Online ordering (via website, social media)

In-store and online considerations for assortment optimization

An omnichannel approach recognizes that today’s consumers have many ways to shop. At every touchpoint, they expect a seamless, convenient experience with options that keep them engaged. Some product lines can perform stronger in one channel over another. For example, shoppers may purchase heavy bulk kibble for their pets online – for effortless pick-up or delivery – and prefer to explore treat options in stores.

Often, local pick-up and delivery orders are fulfilled – or ‘picked’ – from the same shelves shoppers visit in stores. So that means suppliers will want to adequately stock assortments with products to meet in-stores and online demand.

Retail assortment vocabulary to know

Shelf location = strike zone

Units per facing = depth

Adjacencies = Nearby items that influence purchase decisions

Omnichannel = all shopping channels where a customer can interact with an assortment, including physical stores, online stores, mobile apps, and social media

Incrementality = Retailers aren’t only interested in high velocity – they want categories that grow total basket spend.

Tactics and examples of assortment automation

Assortment work used to mean combing through spreadsheets, pulling static planograms, and relying on instinct. A modern data-driven approach surfaces where products should be – by store, by cluster, by channel – based on the real signals coming out of POS and category benchmarks. Below are a few practical tactics that CPG teams use to find (and validate) store-item opportunities, along with simple examples that mirror real-world scenarios.

Spot distribution gaps – Store-item ranking makes it easy to see where high-performing SKUs don’t have distribution. Instead of scanning hundreds of stores, teams can filter by clusters and pull actionable expansion lists.

Example: A brand sees that its gluten-free snack product is a top-quartile performer in suburban stores but missing from 300 urban stores with similar demographics. The opportunity list becomes a clean, data-backed pitch to the retailer.

Compare velocity to category benchmarks – Velocity alone doesn’t tell the full story. Benchmarking a SKU’s performance against its segment or category helps determine whether it’s earning its space.

Example: A frozen brand learns its family-pack waffle SKU is only performing at 60% of the category’s dollars-per-facing in the Midwest. Meanwhile, a chocolate chip flavor is 30% above benchmark but under-faced. The reset proposal: pull back on the slow mover and expand the winner.

Test swaps with what-if scenarios – Automated what-if modeling lets teams preview the impact of replacing low-velocity items with stronger candidates.

Example: A sparkling water brand compares a declining pineapple SKU with its newer blackberry SKU. Modeling shows the blackberry option lifts weekly dollars and doesn’t cannibalize its best sellers, creating a case for a targeted item swap.

Use adjacency insights – Planogram data highlights where adjacencies support stronger sales, especially in seasonal or promotional windows.

Example: A coffee brand sees its winter roast sell best when shelved near flavored creamers. The team uses this insight to build a seasonal adjacency plan for Spring.

Build data-ready visuals for the retailer conversation – Generate clean visuals, velocity callouts, and per-foot productivity metrics to make resets easier to approve.

Benefits of assortment optimization

Assortment optimization serves as a growth lever for both suppliers and retailers. Clean, data-driven assortments influence how categories perform, how easily shoppers find what they want, and how quickly teams can respond to change. A strong assortment strategy delivers benefits across:

Higher category productivity – By right-sizing assortments to protect from underperforming products, leading to better dollars per facing, fewer slow movers, and more predictable performance.

Faster, smarter item expansion – Instead of pitching every SKU everywhere, CPG teams can approach item expansion with precise store-level recommendations.

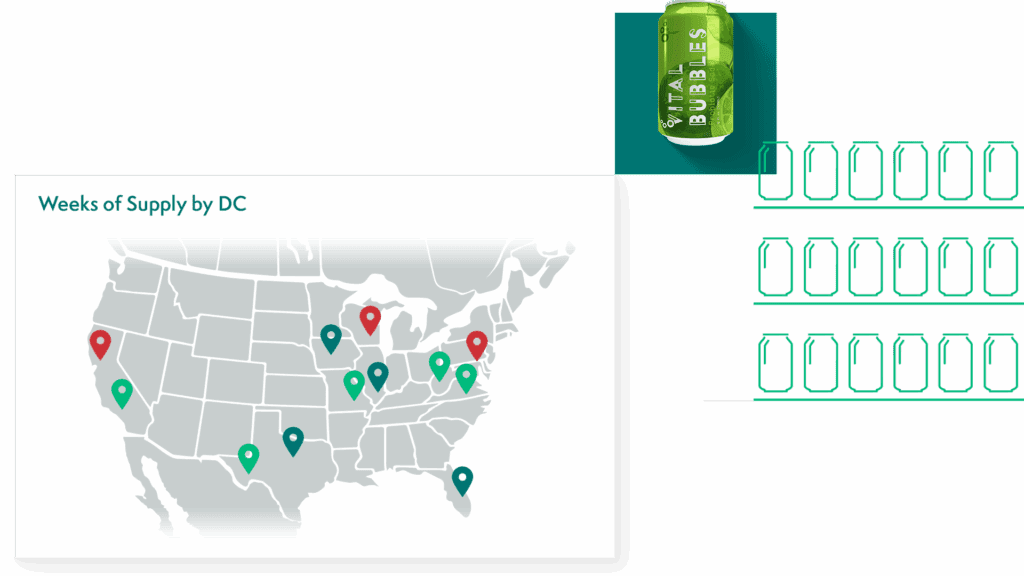

Improved on-shelf availability (OSA) – By modeling store-level demand and adjusting depth accordingly, teams can reduce stockouts and support both in-store shoppers and omnichannel pickers. Stronger planograms also equate to stronger in-store execution.

Resilience during supply shifts – With cleaner data and automated insights, teams can quickly reroute demand, adjust shelf space, and swap items when supply chain disruptions hit.

Other benefits of improved retail assortment plannings includes:

- Reduced overstock and markdowns; Higher profits

- Improved retailer collaboration

- More seamless shopping experiences

Instead of pitching every SKU everywhere, CPG teams can approach item expansion with precise store-level recommendations.

Planogram software transforms assortment optimization

The power of automated planograms is extraordinary. In minutes, they can pinpoint under-earning space, high-performing product candidates, and cannibalization risks for product swaps.

Unlike traditional manual planograms, automated planograms make it easier to:

- Stream in point-of-sale (POS) data without manual data entry, for granular product performance insights

- Layer in syndicated data for valuable industry and competitive context

- Rank sales velocity by product, store, and cluster

- Calculate product cannibalization risks

- Model what-if scenarios for confident swaps

Modeling merchandising for trial and error – without the error

Equipped with automated planogram software and clean data, CPG teams can perform ‘what-if’ scenarios ‘on paper’ before taking risks in the real world. It’s easy to check and project revenue for product candidates, identifying those that have the slowest velocity, typically the slowest 25% of SKUs (or bottom quartile.) It’s just as easy to prioritize products that lift total category sales or margin.

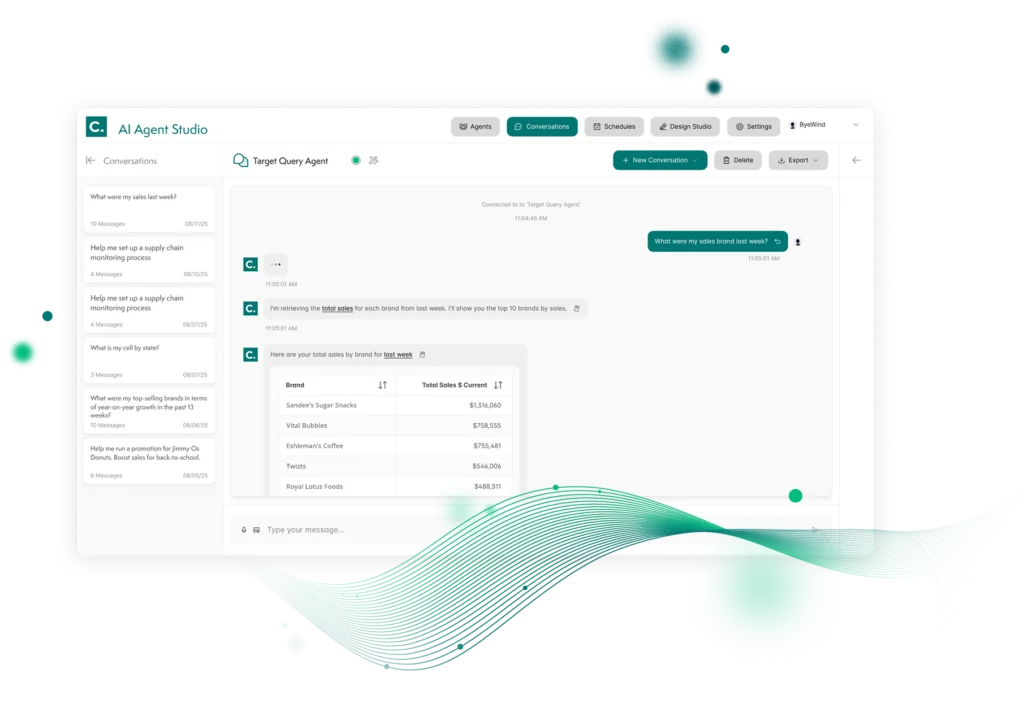

AI strategies for assortments and merchandising

CPGs process millions of rows of data every day – by store, item, location, and more. Making sense of it all can feel impossible for teams, but not for AI. For category management teams especially, daily AI-driven insights enable more powerful assortment and strategy optimization than ever before.

Available to accelerate AI adoption for CPGs and retailers today, the Crisp AI Blueprints catalog contains customizable templates that transform complex datasets into actionable insights in hours, drastically reducing the manual labor involved in preparing data for AI, and building models around it. Some of the most popular AI Blueprints for assortment optimization include:

- Assortment Optimization: Reveal where your product mix is underperforming to fine-tune assortments by store and grow sales.

- Price Elasticity Estimation: Understand how price changes affect demand to fine-tune pricing strategies, maximize revenue, and protect margins.

- Store Clustering: Visualize trends, act faster: Group stores by location, customer demographics, and behavior to uncover hidden sales patterns.

See the full catalog of data science-ready AI Blueprints here

Furthermore, conversational AI has the potential to answer complex business questions in seconds. Imagine not just asking questions like, “What were the regional drivers of our spring assortment performance?” figuratively, in querying data, but literally, leveraging your large language model (LLM) of choice – for instant, actionable insights. By referencing a well of structured real-time and historical data, LLMs can deliver business-friendly responses that fuel curiosity and accelerate decision-making in assortment optimization and merchandising. These tools make it easier than ever for category managers to analyze seasonal performance, refine assortments, and prepare for resets or annual reviews. Get started in tools like Databricks Genie, or Snowflake Cortex; or sign-up for the waitlist to try Crisp AI Agent Studio for Retail.

Available to accelerate AI adoption for CPGs and retailers today, the Crisp AI Blueprints catalog contains customizable templates that transform complex datasets into actionable insights in hours, drastically reducing the manual labor involved in preparing data for AI, and building models around it.

Retailers and suppliers win with assortment optimization

Automated planograms help CPG teams sell in their assortments because they lead with data. They show incremental value, tailored to the retailer’s goals. They set up collaborative conversations where what/if? scenarios can be further explored, visualized, and bought into. By embedding space planning in a robust data ecosystem, automated planograms close the gap between insights and implementation and get rid of the gray area to build retailer trust.Ready to learn more about how automated planograms can optimize assortments for retailers and CPG? Speak with our experts today.

Get insights from your retail data

Crisp connects, normalizes, and analyzes disparate retail data sources, providing CPG brands with up-to-date, actionable insights to grow their business.