How to use data for effective retail marketing

Data is a marketer's best friend

Marketing is crucial for growing CPGs looking to drive retail demand. But it takes more than savvy storytelling: real-time insights on how and where products are selling can help marketers make better decisions and meet customers in the right place at the right time.

Here's an example: An estimated 5-15% of marketed products are out of stock at any given moment, making any marketing on those products a waste of money. But in a recent customer survey, brands that used up-to-date retail data increased sales by an average of 18%.

Brands can work to fill the data-marketing gap in different ways. They can work with brokers, merchandisers, and digital promotion platforms to try increasing sales. They can purchase (expensive) syndicated data, but that involves multiple players, multiple reports, and infrequent updates. Or they can use Crisp, which gives brands access to retailers’ current sales, distribution, and supply chain data, which are all closely entwined (or should be) with marketing.

Clearly, timely data is a marketer's best friend. But where do you start? We surveyed CPG teams using Crisp to offer tips for data-driven marketing that makes a measurable impact.

Knowing where you are and where you should and should not advertise is a powerful tool for marketers.

Identify priorities and opportunities

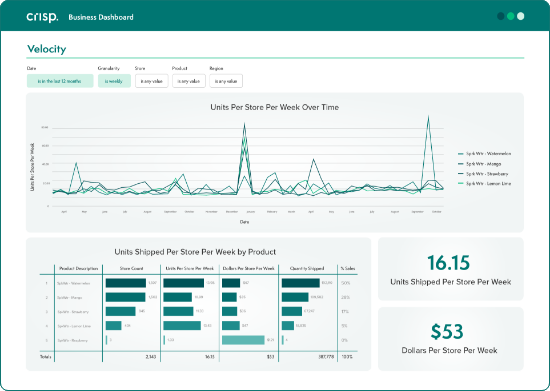

In Crisp’s survey, most brands said they check Crisp dashboards multiple times per day to zoom in on the latest trends -- the first step when planning a new marketing campaign. A strong handle on sales performance helps determine top marketing priorities and opportunities, so we recommend looking for sales hotpots by geography, product, and retailer to determine where sales are trending upward – indicating momentum where marketers can add more fuel to the fire. Marketers should also look for areas where sales are slower, identifying stores that need more support to drive sales. After identifying these target areas, you can download store lists from Crisp to follow up with their marketing teams, advertisers, and buyers.

Drive (and measure) sales lift

One important piece to effective retail marketing: telling customers where to find products. This seemingly obvious best practice is easier said than done, so brands need to start with accurate data notifying them exactly where their product is carried and in stock. Crisp provides access to timely, up-to-date sales and inventory data that’s easy to unpack.

Next up: monitor those same stores' sales data to measure the impact of marketing. Measure sales lift across regions, retailers, and times to actively monitor what’s working and what isn’t and refine your marketing efforts accordingly.

The more you dig into the data, the better. For example, plant-based gelato brand Sacred Serve analyzes Crisp’s reports weekly, which helped the brand increase distribution and see a 25-50% sales lift. Before that, the brand only analyzed data on a quarterly basis.

Analyzing sales trends based on promotions, major holidays, events, and more is also critical. Of course, when a product is underselling, brands can use the data to plan ahead and drive awareness where needed.

Sacred Serve analyzes store-level sales weekly, which helped the brand increase distribution and see a 25-50% sales lift. Before that, the brand only analyzed data on a quarterly basis.

Expedite ecommerce promos

It can be tricky for DTC brands to move into the brick-and-mortar space. As Zest Tea founder James Fayal. “You get spoiled with data in DTC and then you move to retail and realize...‘I don't have any data,’” Fayal said. “I won't know anything for six months.”

At the same time, ecommerce insights are also evolving to better connect the two worlds. With omnichannel data, marketers can more easily plan and align their promotions. Crisp’s dashboards already include data from Shopify and Amazon, along with Target and Walmart, which has a dedicated e-commerce dashboard.

Marketers who want to do their own analysis can also use Crisp to pipe the latest retail data into existing business analytics tools like Microsoft Excel, Tableau, or Google Cloud. “This allows us more time to analyze and draw insights because we aren't having to spend the time manipulating Kehe/UNFI portal data on Excel,” said Dan Capraun, Senior Manager of Sales Planning at The Not Company. "We have leveraged this data for retailer-level support to help increase distribution and promotional effectiveness."

The “stack it high and watch it fly” philosophy doesn’t always work out. It’s impossible to know what’s flying and what’s flailing without accurate data.

Analyze trade spend

Brick-and-mortar retail marketing still matters, but the “stack it high and watch it fly” philosophy doesn’t always work out. It’s impossible to know what’s flying and what’s flailing without accurate data.

Zest Tea’s founder had the same experience: "You’re encouraged to do all kinds of retail promotions as a growing brand, but what’s the long-term effect coming out of those promos? You need data to make those decisions — to figure out if you’re attracting the right type of customers who will actually stick around,” James said.

It’s crucial to understand your trade spend and how it varies by region. Using Crisp’s retailer chargebacks dashboards, brands can do just that — even tracking some promotions by the hour. This data will help you analyze how to approach trade spend moving forward.

“It’s given us much better insights into how we perform on promo and allows us to understand the optimal price point and length of the promo to drive the most ROI,” said Sacred Serve founder Kailey Donewald.

As marketing evolves deeper into digital, CPG brands are often left in the dark about what’s happening out in the real world. But there’s hope, and it starts with easily digestible data. With insights at your fingertips to use how and when you need it, marketers can drive and measure sales lift across retail partners.

Get insights from your retail data

Crisp connects, normalizes, and analyzes disparate retail data sources, providing CPG brands with up-to-date, actionable insights to grow their business.